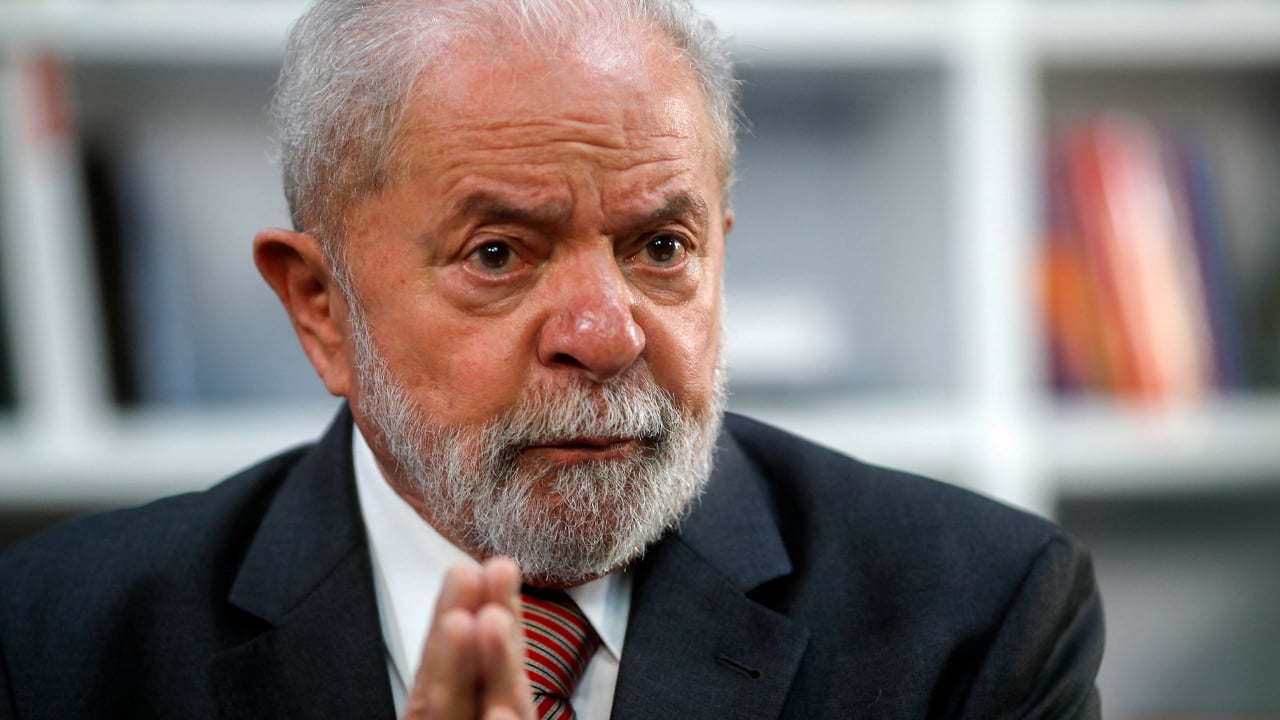

Brazilian President Luiz Inacio Lula da Silva says developing countries should abandon the US dollar and strengthen their own currencies. In a speech given at the New Development Bank in Shanghai, Lula revealed what he ponders at night: “Why should all countries trade with the dollar as a base?”

Brazil’s president wants to weaken the U.S. dollar’s global dominance

Recent discussions have focused on removing the U.S. dollar’s status as the world’s reserve currency, an idea that is becoming a reality in 2023. President Lula, speaking at the New Development Bank (aka “BRICS Bank”) in Shanghai, argued that the greenback’s global dominance should end, as the Financial Timesreported

“Who decided that our currency is weak or worthless in other countries? Lula asked in his speech. ‘Why can’t a bank like the BRICS have a currency to finance trade relations between Brazil and China, between Brazil and other countries?’ We are not used to [the idea], so it is difficult. Everyone is dependent on just one currency,” he added.

Lula’s remarks come after China signed a new deal with Brazil and completed its first liquefied natural gas (LNG) settlement in yuan. Russia is also focusing on trade settlements using other countries’ currencies. In addition, members of the BRICS (Brazil, Russia, India, China, and South Africa) are working to create a new BRICS-based reserve currency. In Shanghai, Lula voiced doubts about the world’s dependence on the greenback.

Lula stressed, “Every night I ask myself why all countries have to trade on the basis of the dollar. ‘Why can’t we trade in our own currency?’ Who decided that the dollar would be the dominant currency after the gold standard disappeared?” he asked.

Financial Times reporters Joe Leahy and Hudson Lockett concluded their report on Lula’s remarks by noting that efforts to weaken the US currency “will face considerable challenges in the short term.” They emphasized that Brazilian miners regularly trade in dollars. But Brazilian and BRICS officials are not the only ones discussing the possibility of the dollar losing its dominance.

Philippine central bank governor Felipe Medalla recentlynoted in an interviewthat the greenback’s presence is slowly fading. He said, “We want a multicurrency world, but right now no other currency has the international markets needed to support [it]. This is the advantage of the U.S. dollar: there is a huge market for government bonds,” Medalla said. He added, “Over time, I think the dollar will become less and less dominant, but it is happening very slowly.”

Do you see a move away from the U.S. dollar as the world’s reserve currency?