Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, explained that a super cycle may be occurring in bitcoin, noting that the cryptocurrency has He noted that the cryptocurrency has outperformed gold by about 10 times since the beginning of this year. The strategist added that that if past trends hold, bitcoin’s volatility is likely to recover relative to commodities as crypto “heads to new highs.”

Bitcoin Supercycle

Mike McGlone, senior commodities strategist at Bloomberg Intelligence (BI), the research arm of Bloomberg, took to Twitter on Tuesday to explain the possibility of a supercycle in bitcoin. He tweeted:

Looking for a supercycle? Bitcoin outperforms commodities on lower risk – Bitcoin outperforming gold, the top performer in old commodities, by about 10x from 2023 to March 20, may be indicative of a supercycle happening in crypto.

The strategist explained that the advantage that bitcoin (BTC) has over most commodities is its “initial stage of low penetration and rate of rise versus decreasing supply.”

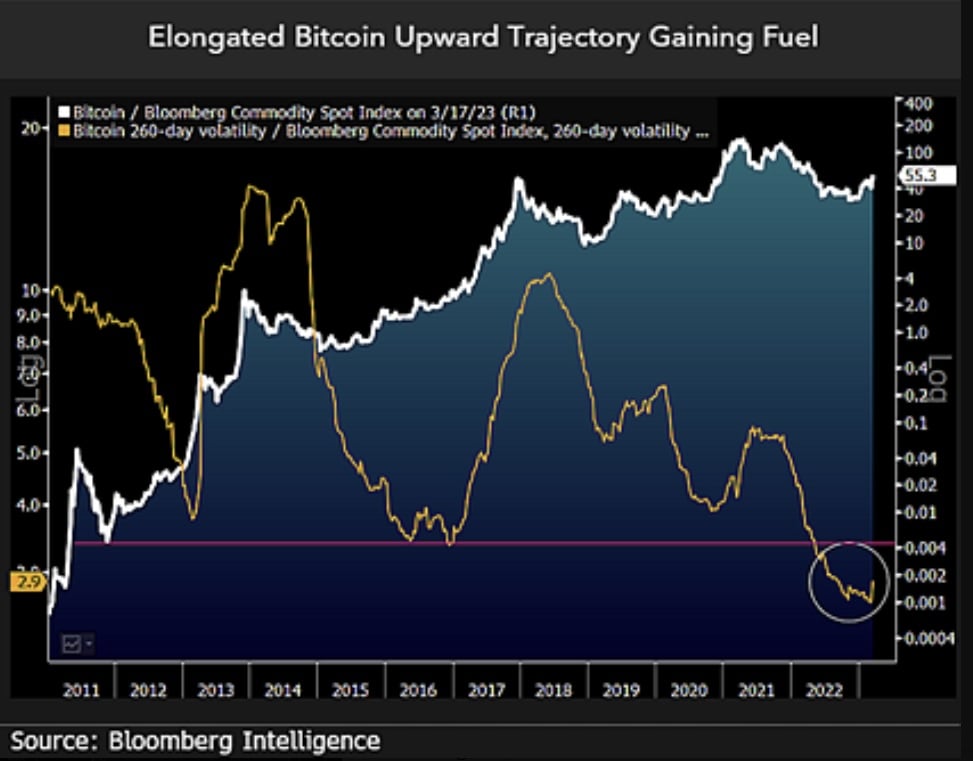

McGlone referenced the chart titled “Elongated Bitcoin Upward Trajectory Gaining Fuel” above and noted that there is an elongated upward trajectory ofBTCprices compared to the Bloomberg Commodity Spot Index. compared to the Bloomberg Commodity Spot Index, which is “typical compared to most assets.” However, he noted that “what is unique compared to commodities is the 260-day volatility as Bitcoin bottoms out from new lows,” and added:

If past trends hold, as Bitcoin heads to new highs, the volatility in crypto likely to recover against the commodity.

A Bloomberg Intelligence strategist explained last week why he expectsBTCto continue to outperform gold and the stock market.” Faced with the Federal Reserve, inflation, and war, 2022 may be a call for a return to risk assets and a new milestone in bitcoin’s maturation.” He tweeted on Friday. McGlone opined, “As the Fed attempts another rate hike cycle, there is no stopping bitcoin from outperforming gold and the stock market.”

In another tweet posted on Saturday, he commented on how recent major bank failures, including Silicon Valley Bank and Signature Bank, have affected bitcoin. The strategist elaborated:

Banking problems may define bitcoin, crypto dollars – With banks under stress against a backdrop of plunging bond prices, bitcoin may be progressing to trade like long-term US Treasuries and gold. Bitcoin holding above $25,000 is a clear sign of divergent strength.

Image credit: Shutterstock, Pixabay, Wiki Commons