Sponsored

2022 was one of the roughest years in the crypto industry, which saw the collapse of Terra LUNA, Celsius and FTX, resulting in wiping over $2 trillion from the crypto market. But the dark horse facing these ugly events was the crypto exchange Bitget.

Despite the market woes, Bitget grew on all fronts. The company has made great strides in building its team, brand, and business over the past 12 months during the crypto winter. The exchange expanded its services to the global Web3 market for the first time in 2022. This effort has pushed its business velocity beyond its limits, making it one of the fastest growing exchanges with the best business momentum.

key areas of development include.

- Climbing the charts ranked in the top three exchanges according to the Boston Consulting Group reportin crypto derivatives trading volume according to the Boston Consulting Group reportRanks in the top 3 according to the report

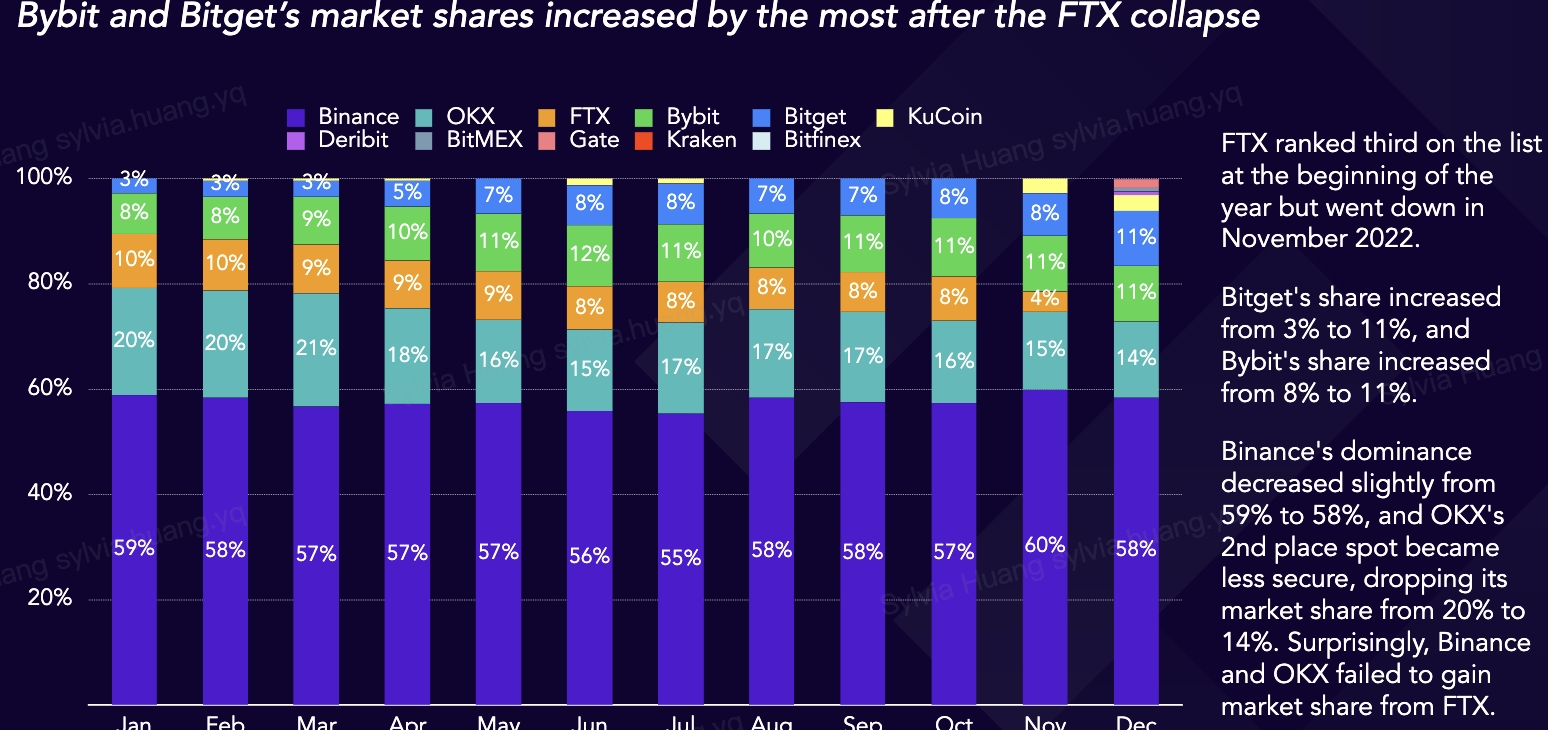

- According to the latestreport from TokenInsightAfter the collapse of FTX, Bitget’s market share in the derivatives market increased from 3% to 11%

- total trading volume increased by more than 300%, due to the popularity of copy trade products

- Growth from barely 200 employees in early 2022 to over 1100 by January 2023

- Became the exclusive crypto exchange partner of Lionel Messi

Looking at the numbers

previously, the company focused on serving customers from only a few Asian countries. By the end of 2022, however, it had become an exchange with more than 8 million users in over 100 countries, with footprints in Turkey, Southeast Asia, Latin America, and Europe.

Bitget saw an increase in total transaction volume of more than 300% with over 4.2 million profitable transactions. The platform’s on-chain data shows that more than 100,000 traders shared more than US$9.7 million in profits on its copy-trade products.

These big numbers were achieved despite a bear market, as other exchanges went bankrupt. Bitjet beat the industry trend because it did four things right.

1. defined copy trades

2.

However, in the four years the platform has been in operation, no emergencies have been identified.

3. Equal priority to retail investors3.

We consistently adhere to the philosophy of putting retail users first, going against many of our peers who focus more on institutional and VIP users

However, Bitget is more proactive in serving individual users and always has them in mind when designing product attributes, profit protection mechanisms, and product thresholds.

With Bitget, individual customers get better service and more favorable rates. The company believes that individual investors are an essential momentum driver in the development of the crypto industry, which is very different from traditional finance.

4. Close Collaboration with Influencers4.

Bidget has accumulated highly motivated KOLs (Key Opinion Leaders) and affiliates over the past four years and has a worldwide close KOL partner network of more than 100,000 close KOL partners worldwide.

The company was the most KOL and KOC (Key Opinion Consumers) friendly platform in the industry. Together with these influencers, the company spreads the most professional trading strategies and high quality content to its users.

Social trading is one of the key parts of Bitget’s system. The company has found a clear development path that fits the characteristics of its platform and keeps it focused. Thus, many of the achievements have only manifested themselves this year, but are precisely the result of the team’s continuous efforts over the past four years.

Advice to fellow builders in a bear market {112}

- Create a differentiated product and become a leader in your field: people are naturally drawn to the number one in your industry for a good reason.

- Security and Protection