Two days ago, Bitcoin.com News reported that crypto hedge fund Three Arrows Capital (3AC reported about the company. Now crypto firm Finblox is feeling the effects of 3AC’s troubles, and several digital currency firms are liquidating leveraged positions in the hedge fund.

Speculation continues

regarding the financial difficulties associated with Three Arrows Capital.

There are many rumors and speculation surrounding crypto hedge funds There are many rumors and speculation surrounding Three Arrows Capital (3AC), which seems to be affecting other crypto companies as well. Perhaps 3AC’s problems started with its investment in the Terra blockchain, which purchased $559 million worth of locked LUNA (now luna classic), now worth just under $700. the Defi Edge (@thedefiedge) , a Twitter account, explained in a Twitter threadthat after the Terra fallout, 3AC allegedly tried to use more leverage to get its money back in order to recoup losses on the Terra investment.

However, after the collapse of Terra LUNA and UST, the market was further shaken, causing a significant amount of liquidation across the crypto industry; another account called Degentrading (@hodlkryptonite)said3AC borrowed from all major lenders and the company faced considerable liquidation this week. Additionally, there wasspeculationthat 3AC was dumping large amounts of a Lido lap ether product called stETH, which was putting a strain on the stETH pegs. Subsequently, a 3AC-backed company called Finbloxexplained in detailthat all users’ rewards (up to 90% APY) had to be suspended, and the platform also upped its withdrawal limits.

Additionally, after The Defi Edge ended the Twitter thread, the company (Protocol X), which 3AC invested in and wished to remain anonymous,informed The Defi Edge that3AC owns the treasury of the project.” 3AC invests in various seed rounds of companies. The protocols are usually funded by USDC / ; USDT Well, the treasury usually sits on nothing. So the common deal that the 3AC has made with their protocols is to ‘manage’ their treasury,” The Defi Edge wrote. Twitter accountadded:

3AC’s treasury management. 3AC gave an 8% APR guarantee to the treasury. So Protocol will park the funds raised by 3AC plus an additional portion of their treasury. Protocol is, well… felt safer because it was the 3AC. Protocol X mentioned that ghosting is indeed occurring. I also spoke with the other two protocols and they said they too were ghosted, that 3AC holds a portion of the treasury and they have no idea what the status of the cash is.

Bitmex and Deribit liquidated their 3AC positions; co-founder Kyle Davies said the hedge fund will “find a fair solution for all constituents”

{54

In additionreportpublished by The Block noted that Bitmex has liquidated its 3AC position, but it is not clear to what extent it has been liquidated.” A Bitmex spokesperson told The Block, “This is a secured debt and does not involve any customer funds.” We are not going to wax poetic about our limited exposure and strong capital position like other brands – instead, we will demonstrate that by providing a reliable and liquid trading venue for our users every day, no matter what the circumstances.” On Twitter, crypto derivatives exchange Deribit also disclosed information about 3AC’s business dealings.

“I can confirm that Three Arrows Capital will be a shareholder in our parent company beginning February 2020.” Deribit said Thursday.” Due to market developments, Deribit has a small number of accounts with a net debt owed to the Company that is considered potentially difficult. If this debt is not repaid, we are financially sound and our operations will not be affected. We can confirm that all client funds are safe and insurance claims are paid in full as they are. Any potential losses will be covered by Deribit,” the exchange added

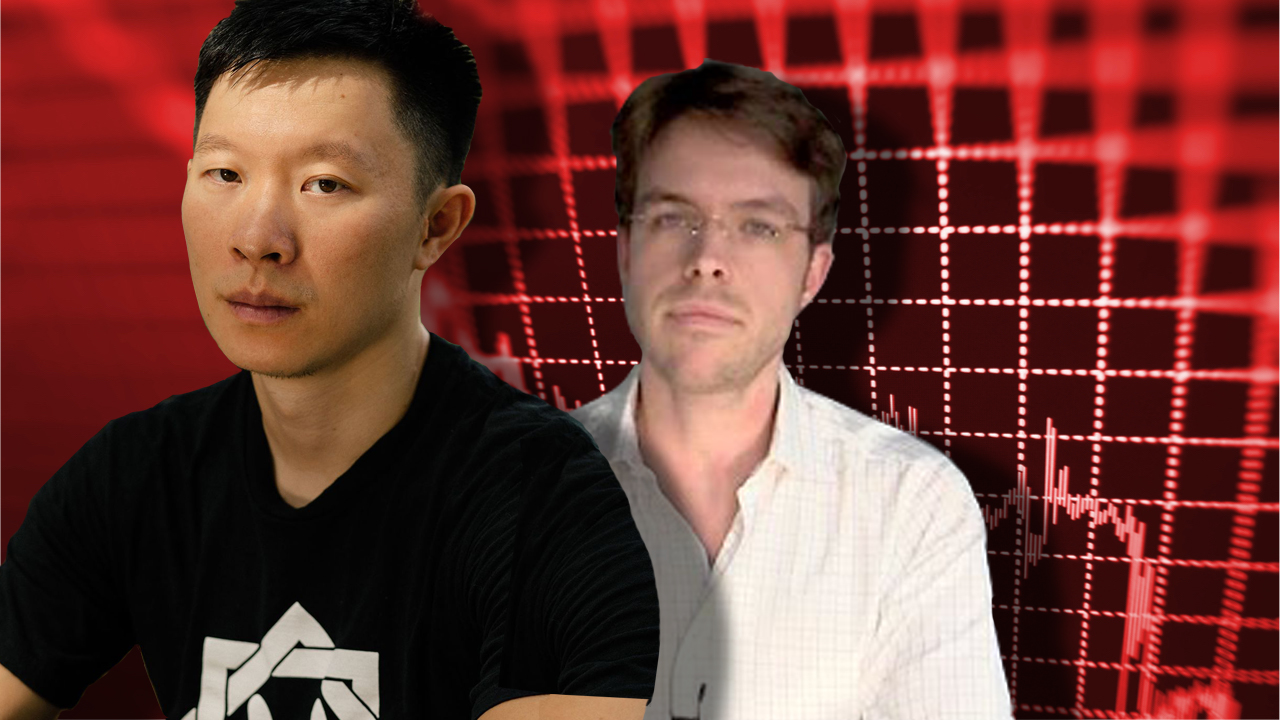

In the same report published by The Block, the editorial’s author noted that he also contacted both FTX and Bitfinex about the 3AC transaction; FTX told The Block author Yogita Khatri that it does not comment on its customers and Bitfinex explained that it had “closed positions at a loss without liquidating,” Khatri’s report detailed.Bitfinex’s statement said that 3AC had removed all funds from its exchange.Rumors and speculation about 3AC’s business dealings Since the rumors began to fly, so far the public has only heard from the company’s co-founder, Su Zhu, once on Twitter.

The cryptic tweetdoes not mention specifics, but “We are in the process of communicating with the parties involved and are fully committed to resolving this.” said 3AC co-founder Kyle Davies, who has not tweeted since June 9. But Davies, speaking with the Wall Street Journal (WSJ),said: “We have always been crypto followers and we still are. We are committed to fixing things and finding a fair solution for all constituents.” The WSJ report noted that 3AC is seeking help from “legal and financial advisors” to quell the company’s financial burdens.

Image credits: Shutterstock, Pixabay, Wiki Commons