Digital collectibles sales surged following news of Donald Trump’s indictment in New York on Thursday. Meanwhile, one report revealed that despite a weak March, the market for non-fraudulent tokens (NFTs) had its strongest quarter since early last year, with transaction volume reaching $4.7 billion.

Trump NFTs surge as former president indicted

Officials“…NFT marketOfficea data shows a surge in sales of Trump digital trading cardsafter the 45th President of the United States, former or current, became the first American head of state to be criminally indicted.

A sealed indictment by a grand jury in Manhattan includes more than 30 charges related to business fraud, media reports revealed. This follows an investigation into an alleged hush money payment scheme involving adult film star Stormy Daniels dating back to the 2016 presidential election.

The NFT collection was announced by Trump on social media in December, when the first badges were sold within hours of the launch. Thousands of tokenized cards depict him as exactly every masculine thing, even the Superman character.

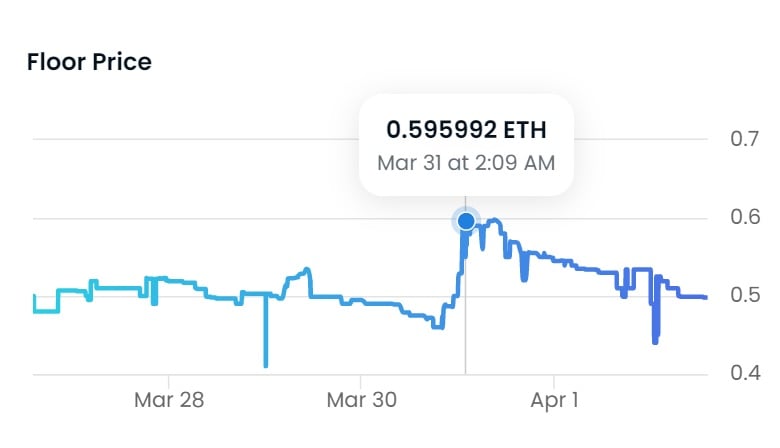

After the indictment, sales were up well over 400% in one day, with a volume of over 90. ETHon Thursday (about $166,000 at the time of writing), exceeding the floor price of 0.59ETHon Friday, March 31, statistics from Opensea showed. The number of owners is now approaching 14,000, while prices have since returned to more average levels.

NFT trading volume reached $4.7 billion in Q1 2023

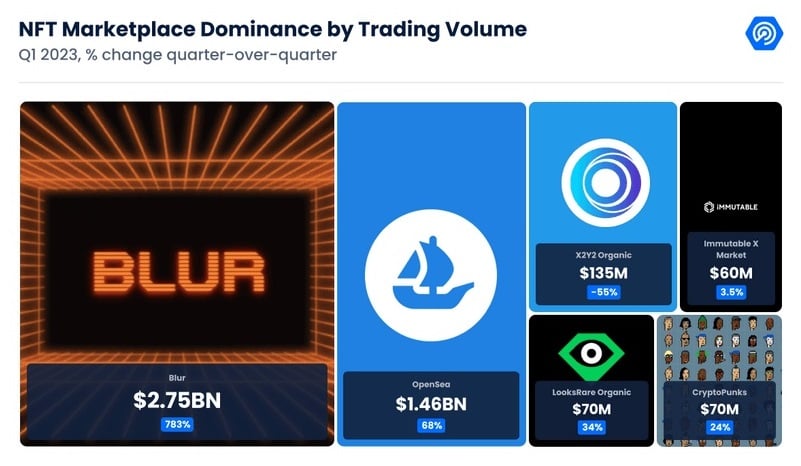

According to a report by Dappradar, a global decentralized app store, NFTs have had a generally strong first quarter of the year, although sales declined significantly in March; overall transaction volume expanded by more than 137% to $4.7 billion in the first quarter of 2023, the highest growth since the second quarter of 2022 This was the highest growth since the second quarter of 2022.

Dappradar also noted that Q1 was the first quarter in which Onpensea did not dominate the market for non-fiat tokens.” He emphasized that “the NFT market is evolving rapidly, with new players emerging and dynamics changing.

“We have not recorded such a percentage since February 2021,” the platform noted in ablog post titled “NFT Market War Doubles Trading Volume in Q1,”referring to the competition between Opensea and Blur. The latter had more than 57% of the market in the first three months of the year and over 70% in March.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Koshiro K / Shutterstock.com.