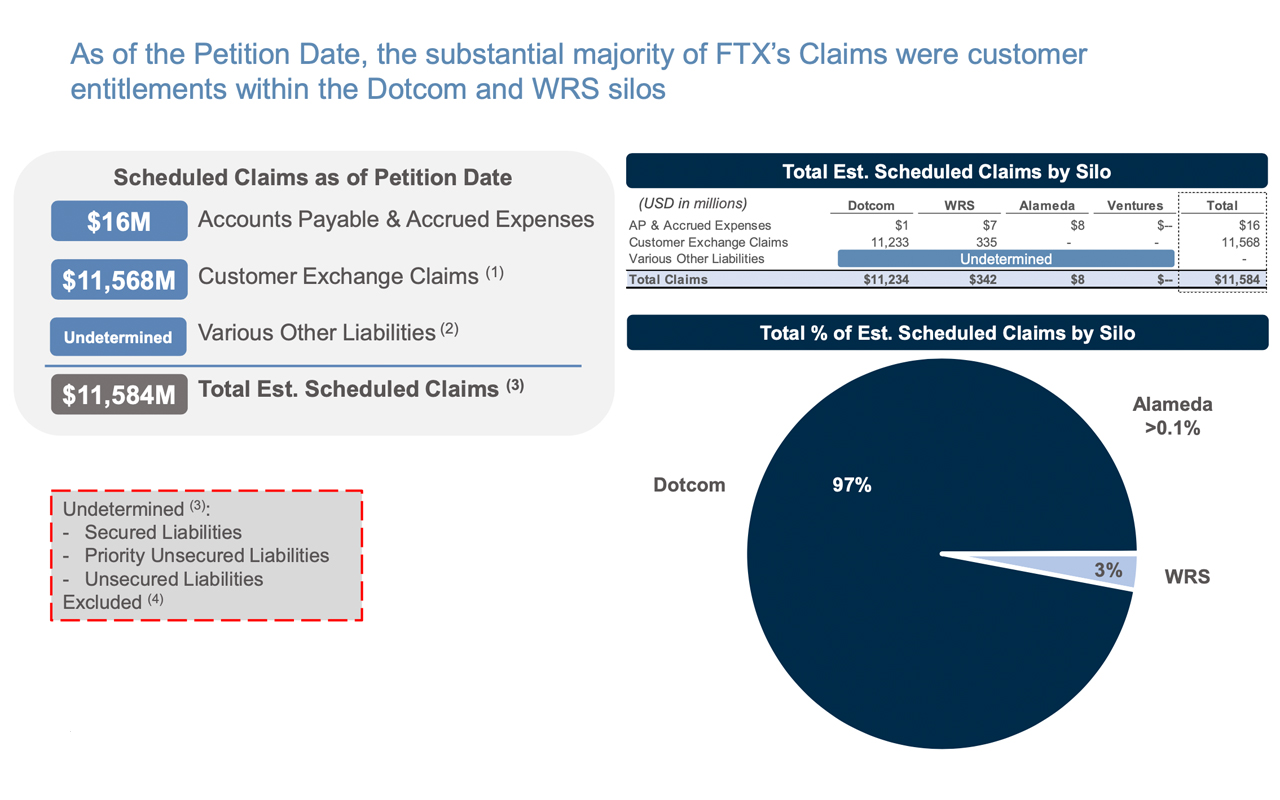

According to a presentation just filed by FTX’s debtors on March 16, Sam Bankman-Fried’s company had an intercompany balance sheet at the time of its Chapter 11 filing that 6.8 billion hole; FTX and its conglomerates owed approximately $11.6 billion, including customer claims and various other liabilities.

FTX’s $6.8 billion gap

FTX’s debtors have released a third presentation outlining FTX’s debt and liabilities. This presentation revealed that while significant funds were owed to customers, FTX and its few subsidiaries owed funds to certain vendors, suppliers, and unpaid invoices. Vendors include Jimmy Buffett-owned Margaritaville Beach Resort, Amazon Web Services (AWS), Fairview Asset Management, Stripe, Meta, Trulioo, Spotify, the Turner Network Television, and American Express.

The advisors concluded that when FTX filed for bankruptcy, there was a $6.8 billion gap in the balance sheets of more than 100 companies under its umbrella. According to the presentation, about $4.8 billion of this was against a massive $11.6 billion fund; FTX US had a shortfall of about $87 million, despite Bankman Fried’s repeated assertions that the US subsidiary was solvent. According to the advisor’s memo, the ousted FTX co-founder’s quant trading firm, Alameda Research, held “the majority of the third-party loans.”

Alameda had interesting relationships with many entities and protocols, as it borrowed from “about 80 different counterparties.” In addition, much of the collateral was based on FTTs, SRMs, and SOLs, and the volatility of crypto assets “resulted in many lenders issuing margin calls and call notices.” FTX borrowers reviewed internal communications, on-chain activity, and loan documents and found that the loans were not recorded in FTX’s historical accounting records.” Additional tracing of wallet and blockchain activity remains an ongoing issue.” The advisor explained.

49 companies are ghost towns and are identified as “dormant” due to lack of past payments and financial information. Nine FTX entities provided payment records directly and 12 FTX entities in Europe and Asia did the same, according to the advisor; about 30 of the FTX entities used Quickbooks to maintain their books of business. As for political contributions, the presentation noted that “the payments were identified on the [Federal Election Commission’s] website and were not classified as contributions in the debtor’s books and records.”

In addition, a page called “Payments to Insiders” shows that Bankman-Fried received approximately $2.247 billion; FTX’s former engineering director, Nishad Singh, allegedly received $587 million; FTX s co-founder Gary Wang received $246 million. Former FTX co-CEO Ryan Salameh allegedly received $87 million.