Governor of the Central Bank of India, Reserve Bank of India India ( RBI) warns that the next financial crisis will come from cryptocurrencies such as Bitcoin and Ethereum. The central bank governor added that cryptocurrencies pose “significant inherent risks” to India’s macroeconomic and financial stability.

Central Bank of India Warns of Cryptocurrencies Causing Next Financial Crisis

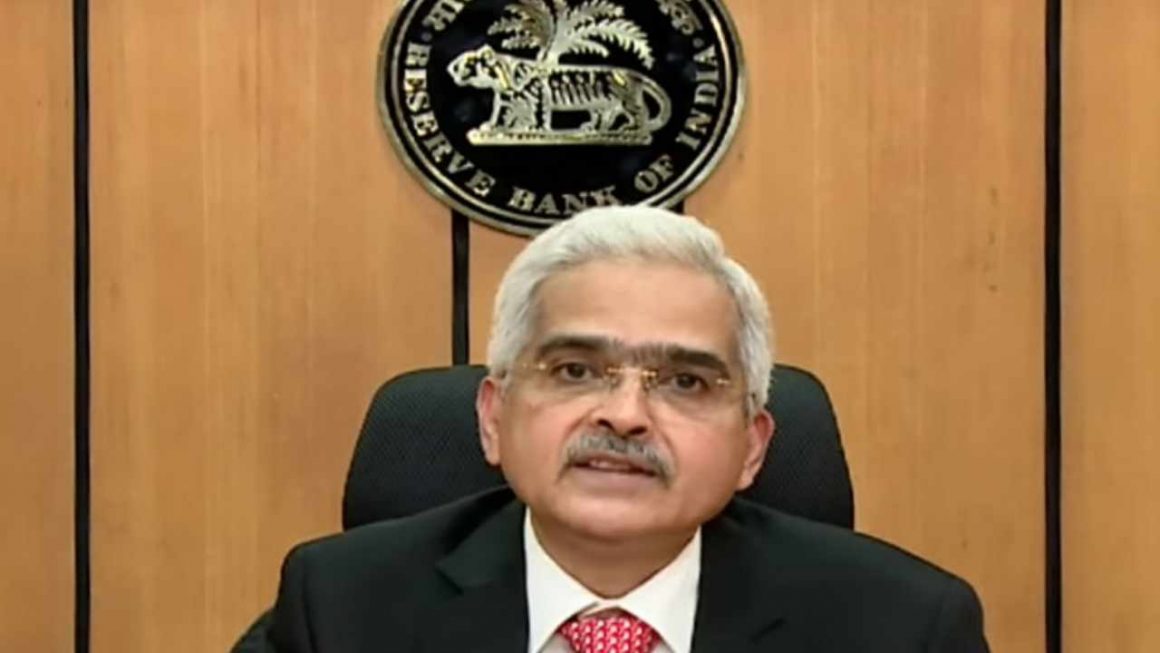

Reserve Bank of India (RBI) Governor Shaktikanta Das Warns of Dangers of Cryptocurrencies on Wednesday warned about Central bankers have warned:

Cryptocurrencies harbor significant risks to macroeconomic and financial stability.

The RBI is primarily concerned with cryptocurrencies with no underlying value, Das said, revealing that cryptocurrencies are “speculative” and should be banned. emphasized.

Indian authorities refer to cryptocurrencies not issued by the government, such as Bitcoin and Ethereum, as ‘private’ cryptocurrencies. Commenting on crypto trading, Das said: To regulate and grow it — take my word for it, the next financial crisis will come from private cryptocurrencies.

Meanwhile, India has its own central bank. We are about to launch a digital currency (CBDC). RBI recently launched both wholesale and retail digital rupee pilots.

Das explained that CBDCs can expedite international money transfers and reduce the need for logistics, including printing memos. Earlier this month, RBI Deputy Governor T. Ravi Sankar argued that India’s central bank digital currency could do anything cryptocurrencies can do.

The Indian government is also working on a national crypto policy. Earlier this week, the government provided Lok Sabha, the lower house of the Indian parliament, with an update on a cryptocurrency bill that was due to be discussed at last year’s winter parliamentary session.

Meanwhile, Indian Finance Minister Nirmala Sitharaman revealed that the government plans to discuss crypto regulation with G20 countries to establish a technology-driven framework for crypto-assets. Last month, she and U.S. Treasury Secretary Janet Yellen discussed cryptocurrency regulation at the 9th India-U.S. summit. Economic and Financial Partnership Conference.

Image Credits: Shutterstock, Pixabay, Wiki Commons