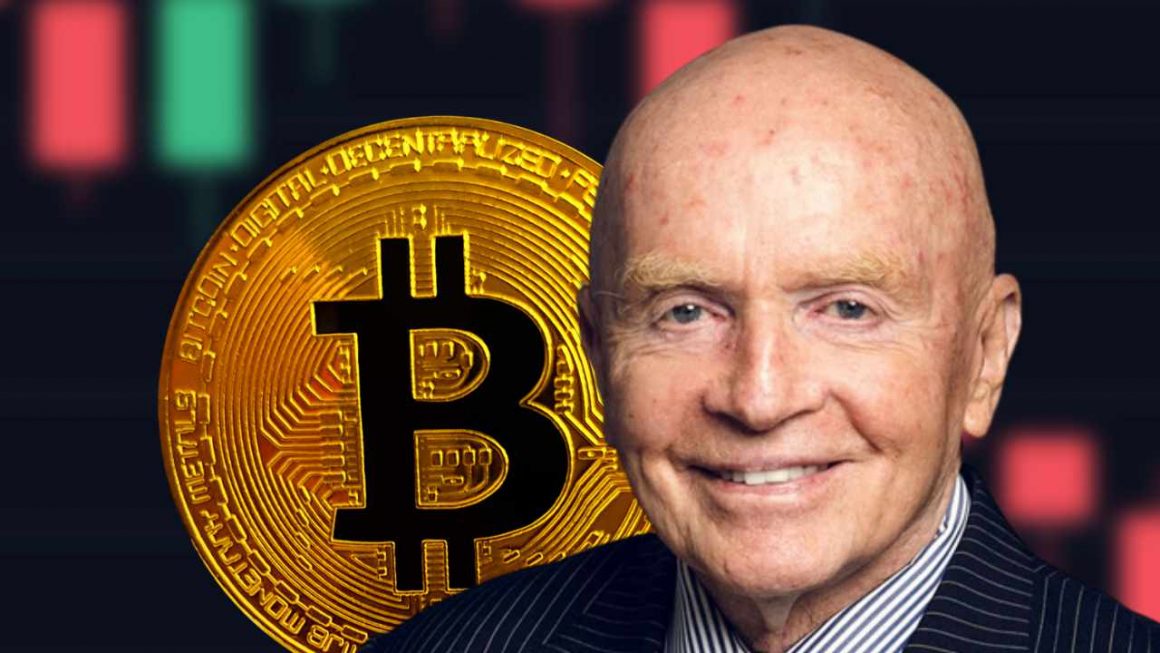

Veteran investor and founder of Mobius Capital Mark Mobius predicts Bitcoin price will drop to $10,000. Nevertheless, he said:

Mark Mobius’ Bitcoin Price Prediction

Mark Mobius, founder of Mobius Capital Partners, said in an interview with Bloomberg on Monday that the latest Bitcoin We have shared our price forecast.

Before starting his own company, Mobius spent more than 30 years at his Franklin Templeton Investments. Previously, he served as Executive Chairman of the Templeton Emerging Markets Group, where he managed a more than $50 billion emerging markets portfolio.

The veteran investor said Bitcoin’s next target is $10,000, saying cryptocurrencies are “too risky” to invest his own cash or the money of his clients.

23}

Regarding the crypto exchange FTX despite the collapse and the subsequent market plunge, Mobius highlighted:

Investors who still trust crypto Crypto stays here because there are some…

This is not the first time a former Franklin Templeton executive has mentioned $10,000 as a Bitcoin price target. In May, he advised investors not to buy dips, warning that the market still has some way to go down. It should be seen as a means of having fun,” he said.

Mobius isn’t the only one who expects the price of Bitcoin to drop to $10,000. DoubleLine Capital CEO Jeffrey Gundlach said in June that he “wouldn’t be surprised at all if [Bitcoin] hit $10,000.” Money bug and economist Peter Schiff said earlier this month that Bitcoin still has a long way to go in its decline. He values BTC at $10,000. Additionally, a recent Bloomberg MLIV Pulse survey showed that the majority of the nearly 1,000 investors who responded said he expects the price of Bitcoin to drop to $10,000.

On the other hand, some are still very optimistic about the price ofBTC. For example, venture capitalist Tim Draper said earlier this month that he expects the price of Bitcoin to hit $250,000 by mid-2023.

Image Credits: Shutterstock, Pixabay, Wiki Commons