Following the Bank of England’s explanation last week of its intervention in the UK bond market and the Bank of Japan’s defense of the yen in the foreign exchange market, the Hong Kong Monetary Authority (HKMA) revealed Wednesday that it intervened in the foreign exchange market The Bank of England intervened in the U.K. bond market on Wednesday, the Bank of Japan said. Hong Kong’s central bank detailed that it intervened in the foreign exchange market to defend the Hong Kong dollar (HKD) against signs of weakness against the greenback on September 28.

HKMA intervenes in the foreign exchange market to defend the HKD against capital flight to USD assets

While the euro and the pound have depreciated 12-17% against the U.S. dollar over the past six months, there has been considerable capital flight to the greenbackin the form of the Hong Kong dollar (HKD)

. However, the Hong Kong dollar (HKD)has fared better against the US dollar than countless fiat currencies around the world.

On Wednesday, September 28, a report detailed that the Hong Kong authorities had taken steps to defend the Hong Kong dollar in the forex market due to a “flight of funds from the HKD market”. South China Morning Post (SCMP) reporter Enoch Yuon Wednesdayexplained that the HKMA said it intervened to “support the peg after the local currency hit the weaker end of the HK$7.75 to HK$7.85 trading band.”

According to SCMP details, this is the first time in seven weeks that the central bank has defended the HKD in this manner, meaning that the HKMA has chosen to intervene in the foreign exchange market 32 times this year. Cumulatively, the HKD/USD exchange rate has depreciated 0.83%, and the de facto central bank has purchased HK$215 billion this year.

Authorities sold roughly HKD27.39 billion in 2022, and a recentreportdetailed that the central bank “purchased local dollars at a record pace to defend the city’s currency peg.” Additionally, India, Chile, South Korea, and Ghana are also defending their currencies in the foreign exchange market, as Hong Kong and Japan have recently tampered in the foreign exchange arena.

Hong Kong’s move to defend the local dollar follows the HKMA, Indonesia, and the Philippinesraising their base bank ratesfollowing the US Fed’s recent rate hike on September 22. In doing so, HKMA raised its lending rate by 75 basis points (bps) to 3.5%.

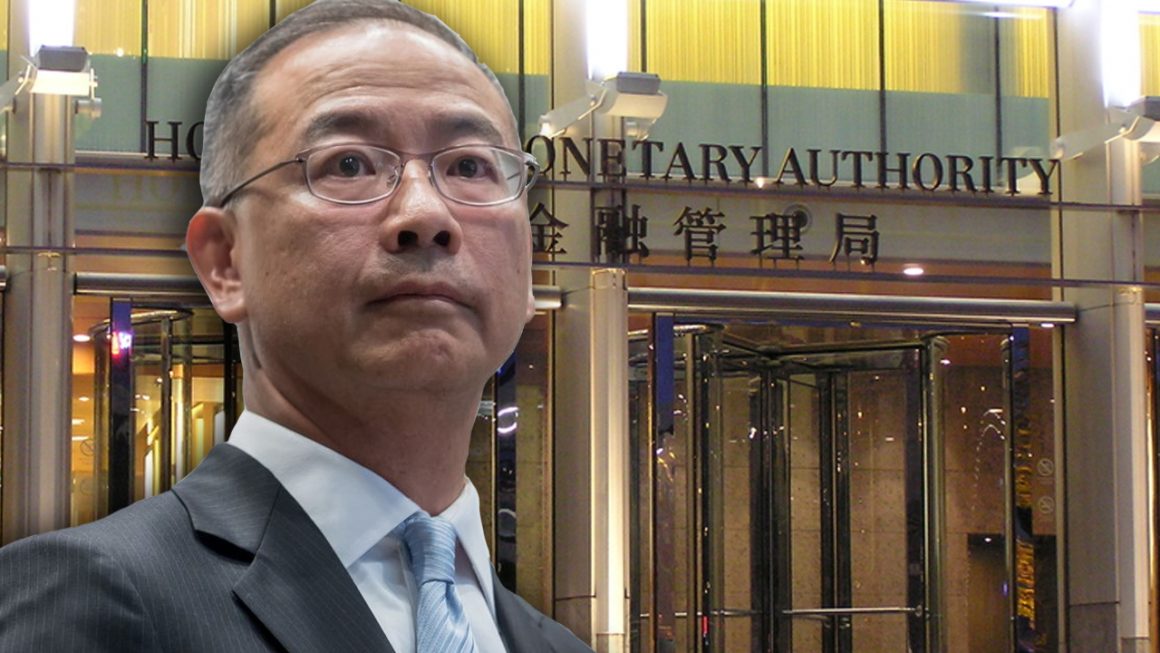

Eddie Yue, third generation and current HKMA chief executive, detailed that he sees no significant risk in the area’s housing market. ‘The latest NPL rate is about 1%, which could be revised slightly upward. But it is still low compared to international levels,” he said last week.

Image Credit: Shutterstock, Pixabay, Wiki Commons