While the market is rising, people feel comfortable placing their crypto assets with trusted third parties that promise increasingly attractive returns, such as centralized exchanges and centralized lending platforms. But the good times never last. As markets peak and monetary policy tightens, firms that overleveraged during the run-up will be exposed to liquidity risk. If you deposited your crypto assets in these products, perhaps unaware of that risk-taking, your assets are exposed to that risk.

It’s not the key, it’s not the coin.

Most people in the crypto industry have heard this phrase before. This phrase is most applicable in the current market environment. Crypto and traditional markets are currently in a period of contraction. During all contractions, whether in the crypto or traditional markets, highly leveraged businesses are more likely to fail. Worse yet, there are countless stories of unscrupulous There are countless stories of companies reaching into their customers’ funds and trying to fill in the gaps.

We strongly recommend moving funds from centralized services to self-managed wallets (sometimes called unmanaged). However, you will not have complete control over your assets unless they are truly self-managed. Read more about the difference between a custodial wallet and a self-custodial wallet here

Risk Exposure to Failed Crypto Products

Self-custody cannot fully protect against the risks associated with failed projects. We experienced this firsthand with LUNA/UST a month ago. However, there is a difference between custodial and selfcustody projects: the risks of LUNA/UST were visible to many because the finances were mostly on-chain, transparent, and freely observable to all. Despite this, many participants, both retail users and “sophisticated” institutional investors, were wiped out.

A far worse problem is centralized crypto products, since their finances are shrouded in mystery. It prevents us from foreseeing their impending problems until they suddenly explode. This is already unfolding now.

Celsius Network, a centralized loan-to-value crypto platform, suddenly announced on June 13 that it was freezing customer assets. This was particularly shocking given the company’s CEO’s tweet the day before in response to rumors that it would freeze customer withdrawals.

Mike, do you know even one person who has a problem with withdrawing money from Celsius?

Why spread FUD and misinformation

If you are paid for this, let everyone know which side you are picking, otherwise our job is to fight Tradfi together…

– Alex Mashinsky (@Mashinsky) June 11, 2022

CelsiusNetworkis suspending all withdrawals, swaps, and transfers between accounts. Acting in the best interest of our community is our highest priority. Our work will continue and we will continue to share information with our community. Learn more https://t.co/CvjORUICs2

– Celsius (@CelsiusNetwork) 6/13/2022

This caused a market-wide sell-off, meanwhile centralized exchange, the world’s largest crypto exchange Binance, announced a “temporary suspension of bitcoin withdrawals.”

Suspend$BTCwithdrawals. We are suspending withdrawals on #Binancedue to a backlog caused by transaction stacks, which should be fixed within 30 minutes. Update.

Funds are SAFU.

– CZ 🔶 Binance (@cz_binance) June 13, 2022

Since then, Allegations Celsius customers remortgage loans their collateral was liquidated, even though they had sufficient assets to do so. Because of account freezes, they were unable to do so; on June 15, the Wall Street Journal reported that Celsior had hired a restructuring attorney to “advise it on possible solutions to its ballooning financial problems.”for Celsior’s clients. terms and conditions indicate that funds may be forfeited.

If Celsius is bankrupt, liquidated or otherwise unable to repay its debts, the Eligible Digital Assets used in the Acquisition Services or as collateral in the Borrowing Services may not be recoverable, and you may have no recourse with respect to Celsius’s obligations under applicable law to may have no legal remedies or rights other than those available to it as a creditor.

Meanwhile, on June 14, rumors began circulating that the well-known crypto hedge fund Three Arrows Capital (3AC) was insolvent; like Celsius, 3AC had sequestered a large amount ofETHin stet. ETHwas being sequestered into stETH. the problem with stETH is that while there is a secondary market for trading staking derivatives, it is far less liquid thanETH. it is far less liquid than ETH. it is far less liquid than ETH. it is far less liquid than ETH

. it is far less liquid than ETH

. While Celsius attempted to secure liquidity by selling stETH, 3AC sold far more; on June 15, rumors of 3AC’s solvency problems were confirmed by a tweet from co-founder Su Zhu.

We are in the process of communicating with the parties involved and are fully committed to resolving this issue

– Zhu Su 🔺 (@zhusu) on June 15, 2022

Self-insurance is insurance

While there is no way to know if an epidemic will occur or how far it will spread (hopefully, we’ve already seen the worst), one thing is for sure: if you self-store your crypto, you have much more control over your money during ups and downs.

Self-custody is certainly more than insurance, but its role as insurance is very important. It is insurance against third parties, whether financial institutions or the government. All insurance comes with a premium, and selfcustody is no different. In this case, it is paid in the form of personal liability, but the benefit is peace of mind.

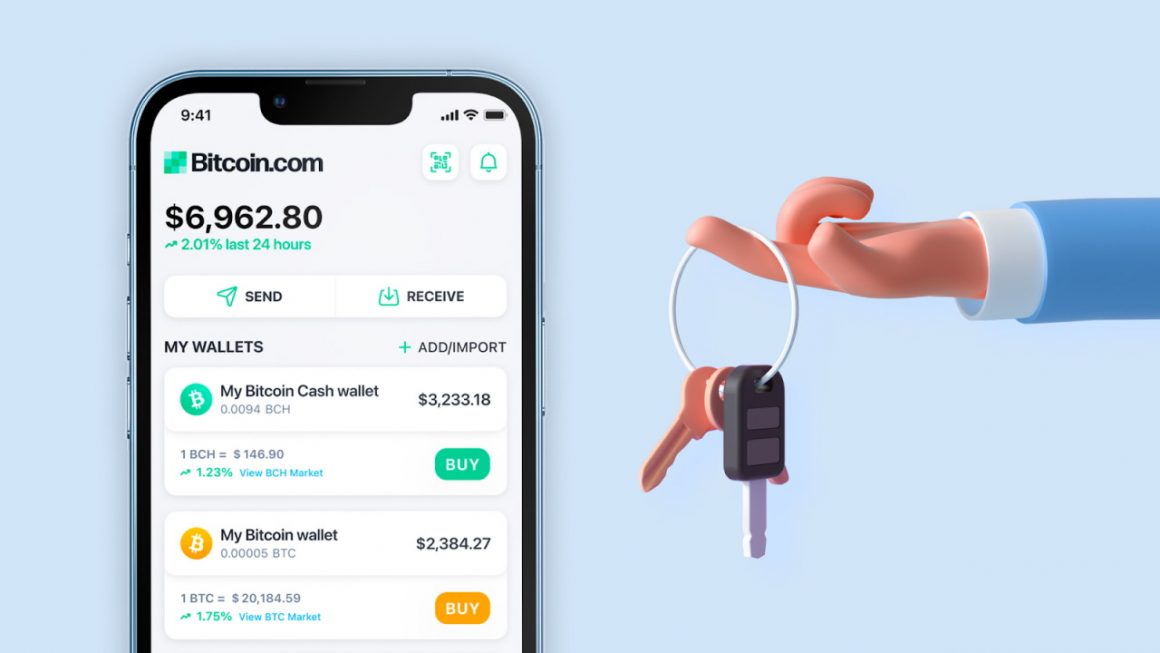

Bitcoin.com’s mission is to create economic freedom, which is why we dedicate the majority of our resources to developing fully self-sufficient other self-sufficient products like the Bitcoin.com wallet Verse DEX Use these to control Bitcoin, Bitcoin Cash, Ethereum and ERC-20 tokens (support for more chains is in progress).

Dennis Jarvis is CEO of Bitcoin.com

Image credits: Shutterstock, Pixabay, Wiki Commons